Merrill Executives Issued Subpoenas About Bonuses

New York Attorney General Andrew Cuomo is asking for details about the tens of millions of dollars paid to Merrill Lynch executives before the Bank of America takeover. Cuomo issued subpoenas on Wednesday to seven executives who received these bonuses even at the same time the company's net losses totaled $27 billion in 2008.In February, Cuomo's legal team heard testimony under oath from former Merrill head John Thain and Bank of America's CEO Ken Lewis, which was part of an investigation into whether the firm broke securities laws on public disclosure of executive compensation.

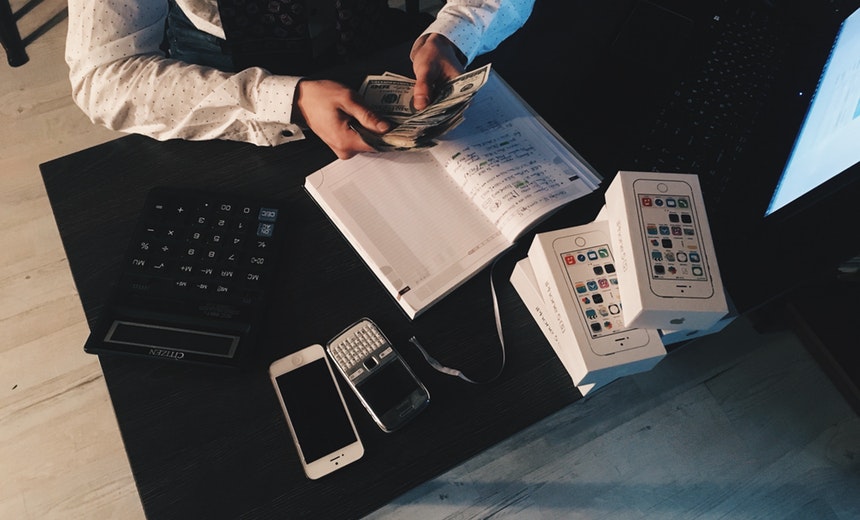

The pay, given mostly in bonuses, is at the center of discussion as banks and companies fail. The amount the AG is investigating is $3.6 billion in bonuses paid by Merrill in late December.

The Bank of America also filed a motion in New York State Supreme Court on Wednesday asking a judge to modify the court-ordered subpoena of Thain. It wants confidentiality about the names and amounts paid to Merrill and Bank of America employees, and doesn't want the AG's office to make the information public. Merrill's top investment banker, Andrea Orcel; its head of global proprietary trading, David Sobotka; and co-head of commodities, David Goodman, are on the list to testify. Others include Peter Kraus, who is the former head of global strategy at Merrill; Thomas Montag, head of global sales and trading; David Gu, head of the global rates division; and Fares Noujaim, head of Bank of America in the Middle East and Africa.

The Wall Street Journal reported on Wednesday that Merrill's 10 highest-paid employees received a total of $209 million in cash and stock in 2008, compared with $201 million paid to the top 10 in 2007. It said 11 top executives were paid more than $10 million in cash and stock last year.

Jobless Claims Down 31,000 in Late February

The latest government report shows the number of Americans filing initial claims for unemployment insurance fell last week, down 31,000 from the 670,000 claims from the previous week. Economists had predicted 650,000 claims.

The number of Americans continuing on unemployment insurance dropped by 14,000 to 5,106,000, edging off the record high set the prior week.

GM Says Bankruptcy May Be Ahead

General Motors Corp.'s filing today with the Securities and Exchange Commission says there is substantial doubt about the automaker's ability to survive. GM filed a 480-page document with the SEC. While the automaker has sustained huge losses and continues to lose money, it also is asking for federal loans to stay in business. The Obama administration, under terms of the $13.4 billion in federal loans the company has already requested, must decide if the company's plans are viable for a sustainable future.

Today's accounting will make it more difficult for the automaker to make its case that it deserves more money from the government in the future. The decision the government is faced with is whether GM has a positive net present value, or otherwise it will ask for repayment of the loans in 30 days -- a move that would most likely spell the end of GM, forcing it into bankruptcy and out of business.

It is up to the Treasury and other government officials as to how it judges the company's net present value, based on assumptions it makes about future sales, car prices and costs for the company going forward. The GM filing also disclosed that the Treasury has already agreed to waive requirements that the automaker meet certain terms of the original loan agreement, including that it win agreement with creditors to convert two-thirds of its unsecured debt to equity by Feb. 17.