Identity Security Demands a Zero-Standing Privilege Approach

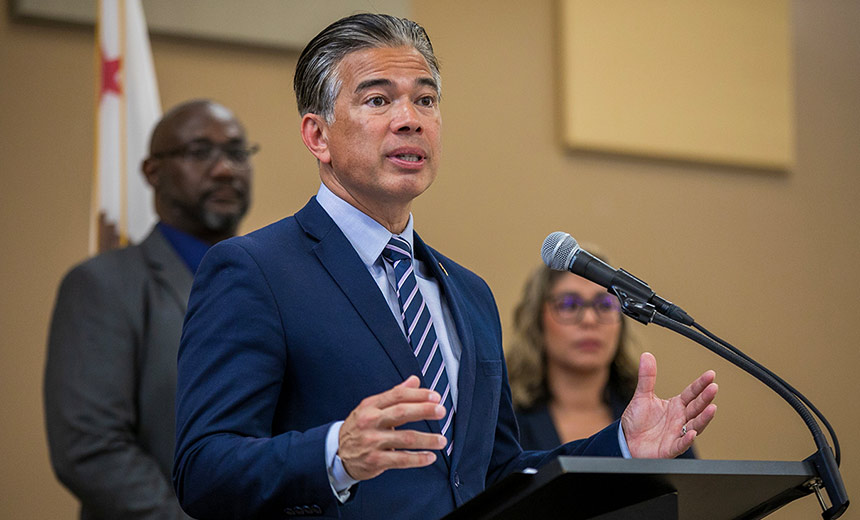

Organizations face growing risks from attackers who no longer hack in. They log in using compromised credentials. Chris Hills, chief security strategist at BeyondTrust, said this shift in tactics makes identity-first cybersecurity technology a key requirement.