Card Not Present Fraud , Enterprise Mobility Management / BYOD

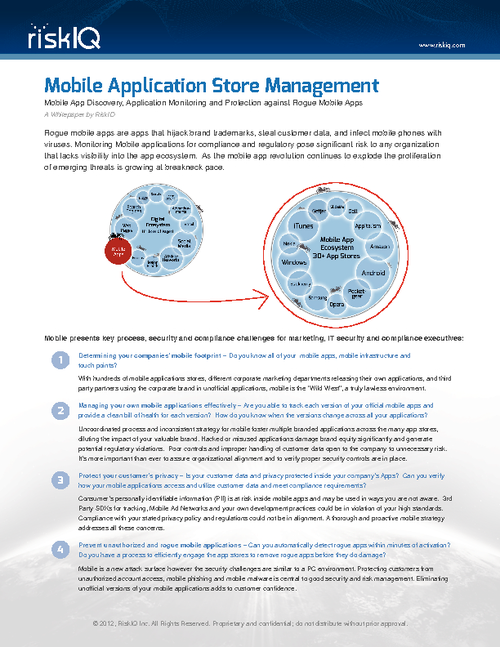

The New Face of Mobile App Security

VASCO's Benjamin Wyrick on the 2016 Mobile Banking Outlook

When Benjamin Wyrick of VASCO Data Security looks toward 2016, he sees financial institutions embracing new mobile banking apps that are at once convenient and secure. What are the keys to making his vision a reality?

Wyrick, vice president of sales and business operations at VASCO, sees the coming year as a critical junction for financial institutions, as mobile banking apps truly come of age.

"Historically, [banks] sometimes adapt for fraud, sometimes they adapt for convenience," Wyrick says. "I think we're in a unique place today where we have the right solutions to enable both. So there's no longer that need to make a decision about one over the other."

And as we head toward 2016, he says, mobile banking is not just a channel; it's becoming the dominant channel through which customers choose to interact with their banking institutions. And mobile is also becoming central in banks' efforts to manage identities and fraud.

"We often talk about the intersection of fraud/risk and user convenience over time, which is the point where action must be taken," Wyrick says. "We see mobile as the center of fraud prevention and digital identity management - not just another channel, but the path of the customer to the bank."

In an interview about the 2016 mobile banking landscape, Wyrick discusses:

- Common pitfalls for banks seeking to provide both convenience and security;

- A checklist of technology must-haves;

- Lessons learned from VASCO's own customers.

Wyrick is responsible for managing VASCO Data Security's business operations in North America. He joined the company in 2005 and has been a key contributor to the overall growth of the company's strong authentication business in North America. Wyrick and his team have successfully managed security projects for some of the largest financial institutions, enterprises and online applications around the world. He is a frequent presenter at banking and financial industry conferences and Web seminars throughout North America on preventing cyberfraud as well as account and transaction security for online and mobile applications.