Cybercrime , Fraud Management & Cybercrime , Fraud Risk Management

Alleged BEC Scammer Extradited From Ghana

Prosecutors: Scheme Targeted Memphis-Based Real Estate Company

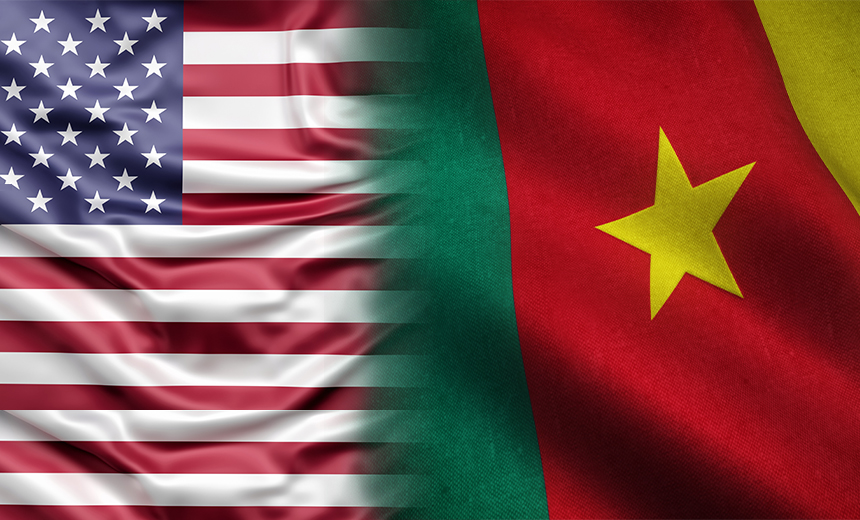

A Ghana resident has been extradited to the U.S. to face charges of targeting a Memphis-based real estate company in a business email compromise scam and participating in other criminal schemes, according to the Justice Department.

See Also: OnDemand Panel | Resolving an Identity Crisis? Approaches, Impacts and Innovation for Fraud & KYC

Maxwell Peter, 27, also known as Maxwell Atugba Abayeta, faces numerous federal charges, including conspiracy to commit wire fraud, wire fraud, conspiracy to commit money laundering, conspiracy to commit computer fraud and aggravated identity theft, federal prosecutors say.

The most serious criminal charge that Peter faces is money laundering, which carries a possible 20-year federal prison term. He remains in federal custody.

Peter was indicted along with more than a dozen others in August 2017 for allegedly carrying out the BEC scam as well as fraudulent check and credit-card scams and a “romance” scam.

The gang shipped or transferred their earnings from these scams to Ghana, Nigeria and South Africa, according to the federal indictment.

BEC Scam

The BEC scam that targeted an unnamed Memphis real estate firm started in the summer of 2016, the indictment states. The company is described as having 115 offices across nine states with 3,000 licensed realtors.

Peter and the others allegedly used spoofed email addresses and VPNs to help disguise their activities, according to the indictment. This allowed him and others to gain access to the email accounts of the company's employees and discover the timing and details of future financial transactions.

Then the hackers allegedly impersonated one of the company's employees whose account had been compromised and communicated with the organization's business clients about changes to accounting details, asking that money be transferred to different accounts, the indictment states. Prosecutors do not specify how much money the scammers allegedly stole by having victims send funds to accounts they controlled.

The indictment also alleges that fraudsters redirected thousands of dollars in funds through a network of money mules based in the U.S. Eventually, the money was transferred to various locations in Africa, according to the Justice Department.

Federal prosecutors allege that Peter and the others obtained stolen personal data, compromised credit card numbers, banking information and IP addresses from underground forums to support their various schemes. The IP addresses and VPNs used in these schemes were based in the U.S. to disguise the alleged fraudsters’ locations overseas, according to the indictment.

A number of those indicted in the case have already pleaded guilty or have been found guilty at trial, receiving prison sentences of between 31 and 78 months, according to the Justice Department. Several other individuals who allegedly participated in the BEC scam and other fraud schemes remain at large, prosecutors charge.

Moneymaking Scams

The FBI's Internet Crime Complaint Center's annual cybercrime report, released in February, found that BEC scams accounted for about $1.7 billion in losses in 2019, or an average of $72,000 each (see: FBI: BEC Losses Totaled $1.7 Billion in 2019).

In June, the Justice Department announced that a former Nigerian entrepreneur had pleaded guilty to charges of carrying out an $11 million BEC scam against the U.K. affiliate of equipment manufacturer Caterpillar (see: Nigerian Entrepreneur Pleads Guilty in $11 Million BEC Scam).

BEC fraudsters have ramped-up their operations during the COVID-19 pandemic, using the healthcare crisis as bait to target victims, according to the FBI (see: FBI: COVID-19-Themed Business Email Compromise Scams Surge).