Automating Governance

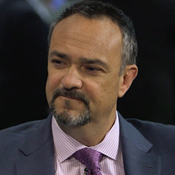

Interview with Modulo CEO Sergio ThompsonIn an interview, Thompson:

- Provides background on the 28-year-old company;

- Explains the benefits of GRC automation;

- Discusses how customers automate GRC to take risk and compliance evaluations and collate them with physical and operational compliance and risk.

Before leading Modulo, Thompson was a principal and founding partner of Brazil's Worldinvest, a financial advisory and business development firm. Prior to Worldinvest, he was the managing director of a Brazilian development bank. He also served in Brazil's Foreign Service as a diplomat and held a senior position in the Brazilian Finance Ministry.

Additional Summit Insight:

Hear from more industry influencers, earn CPE credits, and network with leaders of technology at our global events. Learn more at our Fraud & Breach Prevention Events site.